Conforming Loan Limits Increase for 2023

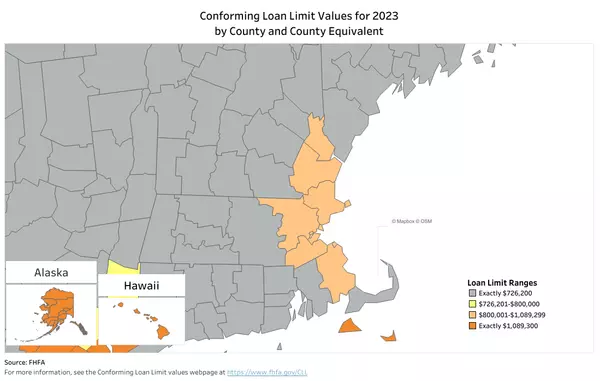

The conforming loan limits for 2023 have been released by the Federal Housing Finance Agency (FHFA) to increase one unit property limits to $726,200, up from $647,200 in 2022. For areas that have been identified as high-cost areas, the limits have increased further. Here are some things you shoul

Mortgage Rates Will Come Down, It’s Just a Matter of Time

This past year, rising mortgage rates have slowed the red-hot housing market. Over the past nine months, we’ve seen fewer homes sold than the previous month as home price growth has slowed. All of this is due to the fact that the average 30-year fixed mortgage rate has doubled this year, severely li

What’s Ahead for Mortgage Rates and Home Prices?

Now that the end of 2022 is within sight, you may be wondering what’s going to happen in the housing market next year and what that may mean if you’re thinking about buying a home. Here’s a look at the latest expert insights on both mortgage rates and home prices so you can make your best move possi

Categories

- All Blogs (126)

- Choosing an Agent (7)

- Condos (4)

- Down Payment (7)

- Downsizing (2)

- Home Buying Process (39)

- Home Equity (11)

- Infographics (20)

- Interest Rates (28)

- Investment Property (2)

- Market Conditions (75)

- Mortgages (32)

- Multigenerational Homebuying (4)

- New Construction (4)

- Renting (7)

- Sustainability (1)

Recent Posts

![Why You Can’t Compare Now to the ‘Unicorn’ Years of the Housing Market [INFOGRAPHIC]](https://img.chime.me/image/fs/chimeblog/20230613/16/original_07f3394b-7997-4582-9a03-472a6048dee4.png)

![Reasons To Own Your Home [INFOGRAPHIC]](https://cdn.chime.me/image/fs/sitebuild/2019929/2/w600_original_7e2aa583-6818-4cc3-a2c4-17c4db55c1d6-jpeg.webp)